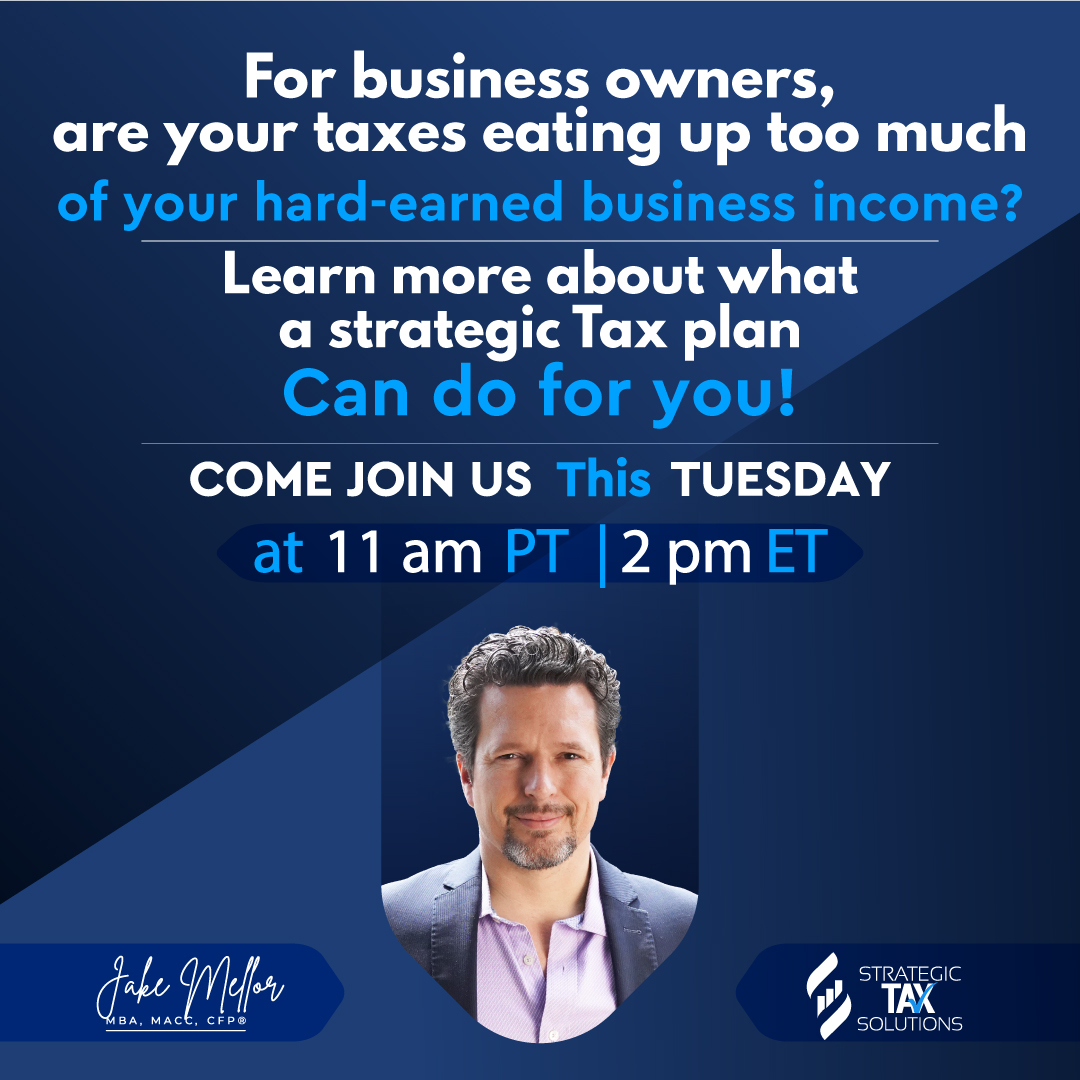

Are your taxes eating away too much of your investment gains or your hard-earned business income?

Our Vision is to help business owners and individuals alike know what options are available to them in regards to Exemption, Deduction, Deferral strategies and other tax-advantaged wealth management tax saving opportunities!

Coached over 300+ CPA Firm Owners on high level Tax Advantaged Wealth Management Strategies.

Helped clients save an accumulated $23 Million in taxes.

Consulted clients on over $110,000,000 in asset management.

———-

Services

~ Highlighted Strategies we have perfected over time ~

Strategic Tax Solutions

~Deferred Sales Trust~

Tax Deferral Strategy

_____

Sale that highly appreciated asset today without taking constructive receipt of the proceeds and defer those capital gains to some future date that proves more convenient to you and your tax situation.

Utilize a Deferred Sales Trust as a business trust for reinvestment purposes so that you can sell property, crypto, stock, businesses, and other highly appreciate assets when the price is high and the time is right to sell, even if the time isn’t right to incur the taxes on those assets.

Defer those taxes to some future date so that you can reinvest the gross proceeds net of attorney fees rather than net of taxes from the various taxing entities. Give us a call to find out more!

~831(b) Captive or Micro-Captive~

Tax Deduction & Deferral Strategy

_____

Much like the 401(k) tax code allows an employer to set aside tax-deferred dollars for retirement, the 831(b) tax code allows a business to set aside tax-deferred dollars for underinsured and/or uninsured risks. The similarities are clear and business owners should consider the risk mitigation advantages.

We havemade it possible for any successful business to take advantage of the same tools previously reserved for Fortune 500 Companies. We have solutions to help you mitigate risk through tax-deducted and tax-deferred dollars. Find out more by giving us a call today!

~Restricted Property Trust~

Tax Deduction/Deferral/Exemption Strategy

_____

C Corporations, S Corporations, LLC’s, and most Partnerships may setup a Restricted Property Trust. Sole Proprietors cannot.

A Restricted Property Trust provides a 100% corporate tax deduction and only partial current income inclusion.

Participants must be able to commit to funding a minimum contribution of $50,000 per year for at least 5-years.

Unlike qualified plans, a Restricted Property Trust may be used exlusively to benefit owners. It is fully discriminatory.

~Charitable Mineral Strategy~

Tax Deduction Strategy

_____

A taxpayer can generate a tax deduction against ordinary income equal to 4 times the cash outlay.

This transaction is based on longstanding rules related to charitable giving and long-term holding rules. It is not a “listed transaction” under current IRS pronouncements.

This level of benefit is available as the cash outlay goes to purchase magnesium from a major supplier in business for over 50 years, under exclusive, discounted terms and the product being donated to a charity at full appraised value.

Due to the exclusive, discounted terms that the taxpayer will receive by participating in the bulk acquisition of the minerals, the taxpayer is able to obtain a leveraged deduction that substantially mitigates his current year tax burden while providing a substantial benefit to a qualified, third-party charity.

Making Conscious Deliberate Decisions that put you back in Control!

TAX-ADVANTAGED

WEALTH MANAGEMENT

STRATEGIC TAX SOLUTIONS

Our Vision is to help business owners and individuals alike know what options are available to them in regards to Exemption, Deduction, Deferral strategies and other tax-advantaged wealth management tax saving opportunities!

INVESTMENT SOLUTIONS

We offer objective solutions to todays situations. Our mission is to help you realize your goals while minimizing your exposure to unnecessary risk. We focus on analyzing your existing holdings and comparing them to your updated investment objectives that correspond with your investment plan. This allows us to know where to adjust in order to build portfolios that meet your needs while emphasizing your expressed objectives.

TAX SOLUTIONS

We excel at tax planning and coordinate your filings for individuals and businesses. We work with you throughout the year to develop a highly personalized plan with tax-saving strategies that are tailored to your unique circumstances and needs so that you are prepared for the tax years to come.

INSURANCE SOLUTIONS

We not only own our own Utah-based independent insurance agency with experts in a variety of insurance fields, but we help medium sized businesses tax advantage of tax-reducing and tax-favored insurance strategies so that they can maximize their wealth and protect their assets. We’re your one-stop shop for all things insurance-related.